All Categories

Featured

State Farm representatives offer whatever from home owners to car, life, and various other popular insurance policy products. It's very easy for agents to pack services for discounts and easy plan administration. Many consumers delight in having actually one trusted representative take care of all their insurance policy requires. State Ranch uses global, survivorship, and joint global life insurance coverage policies.

State Ranch life insurance policy is normally conservative, using secure options for the average American family members. If you're looking for the wealth-building possibilities of global life, State Farm does not have competitive options.

Still, Nationwide life insurance coverage plans are extremely accessible to American households. It aids interested celebrations obtain their foot in the door with a reputable life insurance coverage plan without the much more challenging discussions concerning financial investments, economic indices, and so on.

Also if the worst happens and you can't obtain a larger plan, having the security of a Nationwide life insurance coverage policy might change a buyer's end-of-life experience. Insurance policy companies use clinical exams to evaluate your risk course when using for life insurance.

Buyers have the alternative to change rates monthly based on life conditions. Of training course, MassMutual uses exciting and potentially fast-growing chances. These strategies have a tendency to perform best in the long run when early deposits are higher. A MassMutual life insurance representative or financial consultant can aid buyers make strategies with area for adjustments to fulfill short-term and long-term financial goals.

Equity Indexed Universal Life

Some buyers might be shocked that it provides its life insurance coverage policies to the general public. Still, army participants delight in one-of-a-kind benefits. Your USAA plan comes with a Life Occasion Choice rider.

VULs feature the greatest danger and one of the most potential gains. If your policy doesn't have a no-lapse guarantee, you might also lose coverage if your cash value dips below a particular threshold. With a lot riding on your investments, VULs need constant focus and upkeep. It may not be a great option for people that just want a fatality advantage.

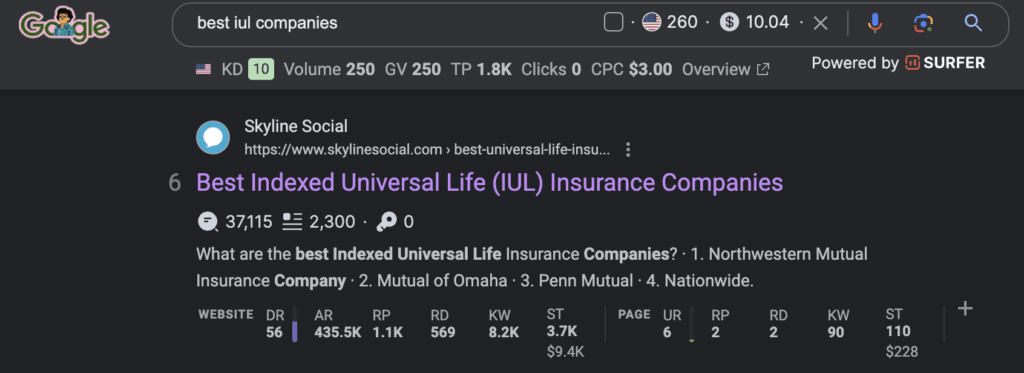

There's a handful of metrics by which you can evaluate an insurance provider. The J.D. Power customer contentment score is a good alternative if you desire an idea of how consumers like their insurance plan. AM Finest's economic strength ranking is another vital metric to consider when choosing a global life insurance coverage business.

This is especially important, as your cash money worth expands based on the investment choices that an insurance provider uses. You need to see what financial investment alternatives your insurance policy company deals and compare it versus the objectives you have for your policy. The best method to find life insurance is to collect quotes from as many life insurance policy business as you can to understand what you'll pay with each policy.

Latest Posts

Financial Foundation Iul

Iul Life Insurance Meaning

Meaning Of Universal Life Insurance